Risk Management

Summit Pharmaceuticals Europe S.r.l. has a comprehensive risk management framework in place to ensure the company’s stability and growth. The framework includes the identification, assessment, and management of various risks such as credit risk, market risk, country risk, liquidity risk and business risk.

In this context “risk” is defined as the possibility of losses due to the occurrence of anticipated or unanticipated situations, and also as the possibility of not achieving the expected return on business activities.

All SPE’s business transactions are conducted in accordance with Sumitomo’s “Business Principles”. No business transaction is performed if considered illegal, non-compliant, dishonest or unjust, inconsistent with the social responsibility of the business, or highly speculative.

Summit Pharmaceuticals Europe S.r.l. Risk Management rule is a document that outlines the principles and internal procedures for credit risk management.

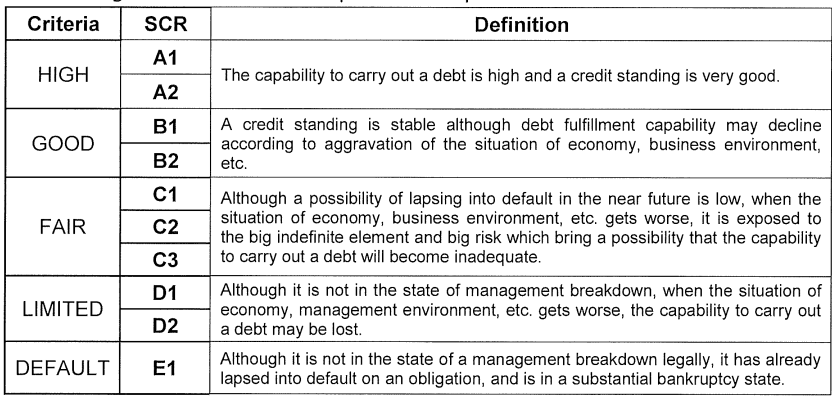

The process includes preparatory check-ups, obtaining necessary approvals, accounting control, and monitoring. It involves analyzing and identifying credit standing, obtaining an internal rating (SCR), and examining the appropriateness of contract terms.

This internal rating (Sumisho Credit Rating) is used to evaluate counterparties’ ability to fulfill their debt obligations. The document outlines the criteria for different SCR levels, from high (A1) to default (E1).

This document emphasizes the importance of controlling outstanding amounts and complying with approved limits. If limits are exceeded, appropriate actions must be taken to reduce the exposure and outlines the steps to be taken in case of delays in contract performance or payment, as well as actions in the event of bankruptcy to minimize losses.

These concepts provide a comprehensive framework for managing credit risk within SPE, ensuring that the company can effectively monitor and mitigate potential risks.